What is SETC?

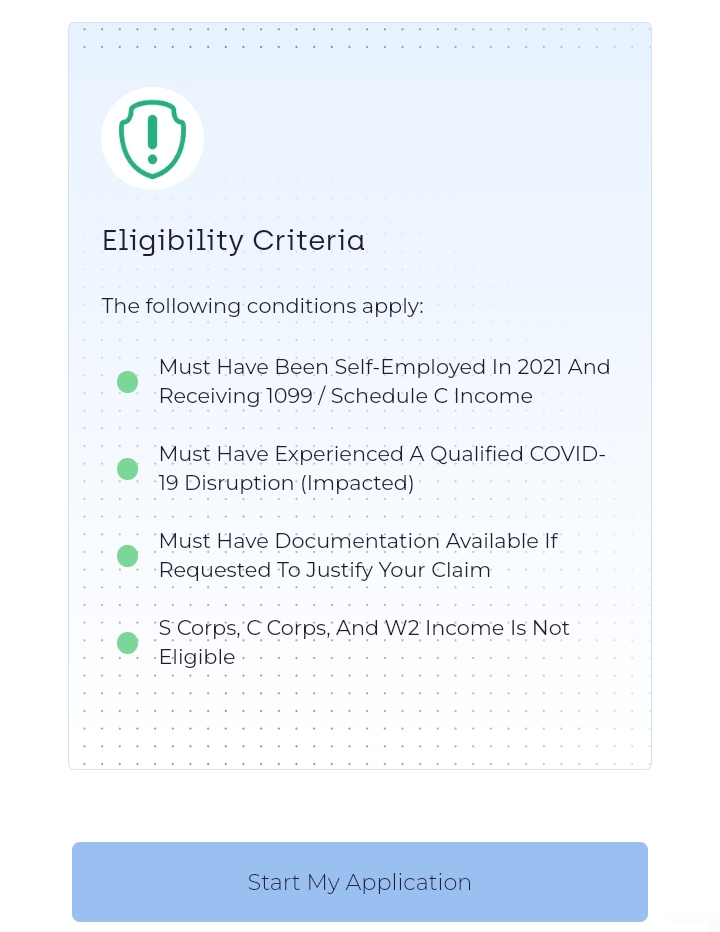

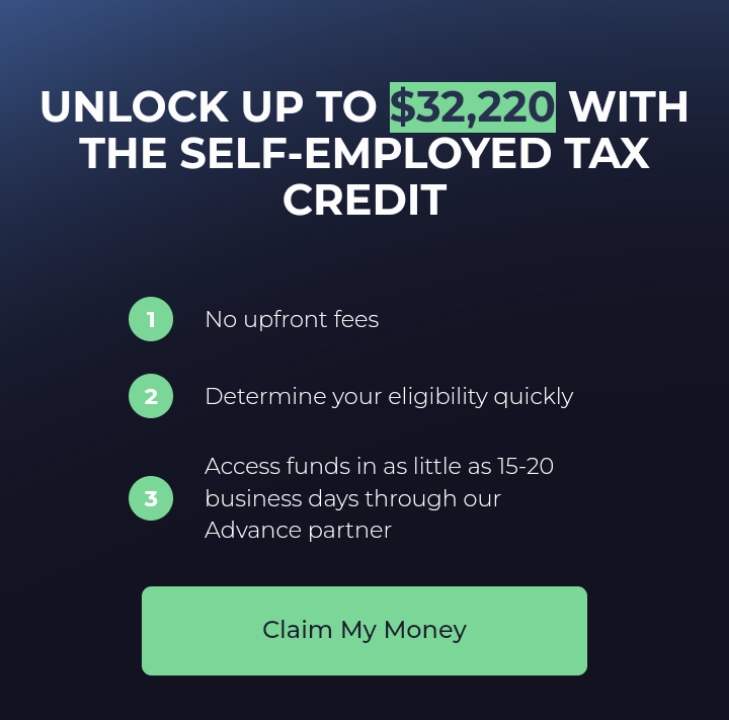

The SETC Program which provides a tax credit for self-employed individuals impacted by qualified COVID-19 disruptions as outlined in the Families First Coronavirus Response Act (FFCRA) and the American Rescue Plan Act (ARPA). Many accountants may not be familiar with this program, so it’s important to be aware of your eligibility. The government has set aside millions in tax credits for self-employed individuals like you, affected by the COVID-19 pandemic.

Unfortunately, many accountants did not (and still do not) know this exists! So, when we discovered this hidden treasure in 2023, we decided to change it. Since then, we’ve partnered with Anchor Accounting Services to create a seamless experience to return over $500 million to qualified self-employed professionals.

We are one of the only accounting services in the country that is returning this money to the rightful owners. This isn’t just any money; it’s YOUR money, already earmarked by the government, waiting for you to claim. If unclaimed, this money— your tax dollars, simply go back into the government’s coffers. We believe it belongs in the hands of the hardworking people who fuel our economy.

Claiming Your Hidden Treasure:

Join the thousands of self-employed individuals who have received their share of $500 million in refunds.

LET’S SEE IF YOU QUALIFY

Why Choose Thenuvision SETC Gig Worker Solutions?